what is the percentage of taxes taken out of a paycheck in colorado

And if youre in the construction business unemployment taxes are especially complicated. Calculating in-handtake home salary.

Individual Income Tax Colorado General Assembly

The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding.

. How do I figure out my take home pay. Similarly you may ask what is the Colorado state income tax rate for 2019. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

Colorado Paycheck Quick Facts. These are contributions that you make before any taxes are withheld from your paycheck. Colorado has a straightforward flat income tax rate of 455 as of 2021.

For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount. 2813 Amount taken out of an average biweekly paycheck. The Colorado bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

672 More From GOBankingRates. Figure out your filing status. Colorado tax year starts from July 01 the year before to June 30 the current year.

It changes on a yearly basis and is dependent on many things including wage and industry. You pay the tax on only the first 147000 of your earnings in 2022. Total income taxes paid.

Any income exceeding that amount will not be taxed. Do this later. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

There is a wage base limit on this tax. The amount of your gross pay. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Switch to Colorado hourly calculator. Colorado income tax rate.

So the tax year 2021 will start from July 01 2020 to June 30 2021. Colorado tax year starts from July 01 the year before to June 30 the current year. If your taxable income was 50000 in 2020 you would calculate your federal tax as follows.

If you earn a fixed salary this is easy to figure out. Employers are required to file returns and remit tax on a quarterly monthly or weekly basis depending on the employers total annual Colorado wage withholding liability. Its important to note that there are limits to the pre-tax contribution amounts.

For a single filer the first 9875 you earn is taxed at 10. For 2022 the limit for 401 k plans is 20500. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Amount taken out of an average biweekly paycheck.

Total income taxes paid. Helpful Paycheck Calculator Info. This is divided up so that both employer and employee pay 62 each.

For the 2019 tax year the maximum income amount that can be subjected to this tax is 132900. Just enter in the required info below such as wage and W-4 information and our tool will perform the necessary calculations. Use ADPs Colorado Paycheck Calculator to calculate net take home pay for either hourly or salary employment.

For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. At the time of publication the employee portion of the Social Security tax is assessed at 62 percent of gross wages while the Medicare tax is. Social Security tax.

Colorado Unemployment Insurance is complex. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Colorado income tax rate.

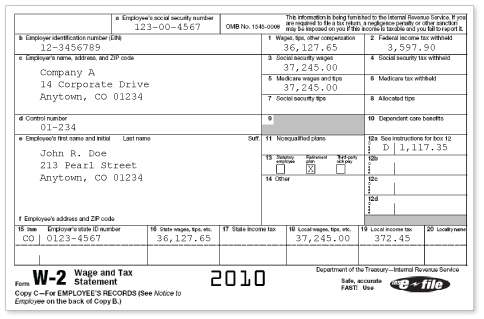

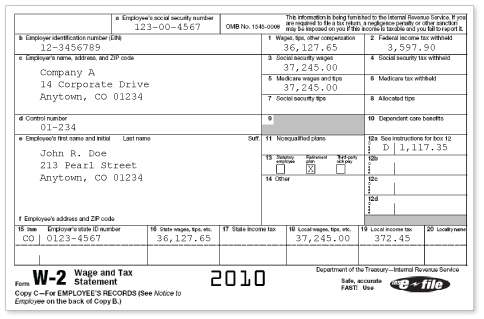

Only the very last 1475 you earned would be taxed at. How much taxes are taken out of a 1000 check. Every employer must prepare a W-2 for.

Calculate income tax Step 4. Just divide the annual amount by the number of periods each. For example if you want 60 taken out of each paycheck on top of the dollar amounts youve entered for the tax year then all you need to.

Elected State Percentage. Colorado Paycheck Quick Facts. All data was collected on and up to date as of Jan.

215 Amount taken out of an average biweekly paycheck. Colorado Salary Paycheck Calculator. For 2022 the Unemployment Insurance tax range is from 075 to 1039 with new employers generally starting at 17.

Both employee and employer shares in paying these taxes.

Here S How Much Money You Take Home From A 75 000 Salary

Individual Income Tax Colorado General Assembly

Understanding Your Pay Statement Office Of Human Resources

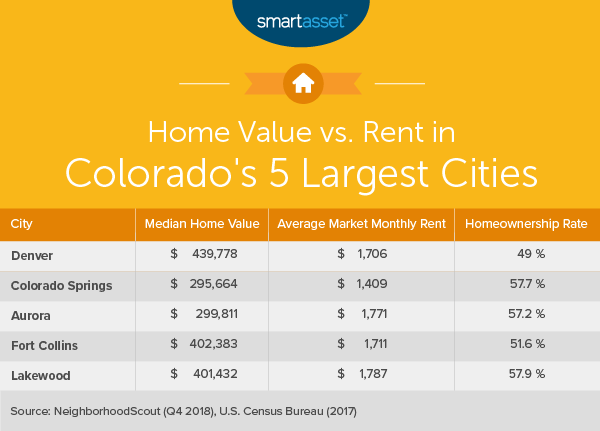

The Cost Of Living In Colorado Smartasset

How To Read Your W 2 University Of Colorado

Colorado Paycheck Calculator Smartasset

A Complete Guide To Colorado Payroll Taxes

We Asked People What They Know About Taxes See If You Know The Answers Colorado Public Radio

Individual Income Tax Colorado General Assembly

Math You 5 4 Social Security Payroll Taxes Page 240

How Much Should I Set Aside For Taxes 1099

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Individual Income Tax Colorado General Assembly

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Colorado Paycheck Calculator Adp

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Colorado Paycheck Calculator Smartasset