do nonprofits pay taxes in california

The Welfare Exemption was first adopted by voters as a constitutional. But there is no similar broad exemption from sales and use tax in places like California.

How To Start A Nonprofit In California 14 Step Guide

In other words nonprofit and religious organizations in general are treated just like other California sellers and.

. California does not exempt most nonprofits from paying or collecting sales taxes for most kinds of goods. For example in California nonprofits pay sales taxes but charitable organizations may not need to in New York Texas or Colorado when buying things in the conduct of their regular charitable functions and activities. If you have a charity or nonprofit you may qualify for tax exemption.

File your tax return and pay your balance due. Nonprofits Exempt From Ad Valorem Property Taxes. The new law means that for many taxpayers the new increased standard deduction may exceed the deductions they currently itemize.

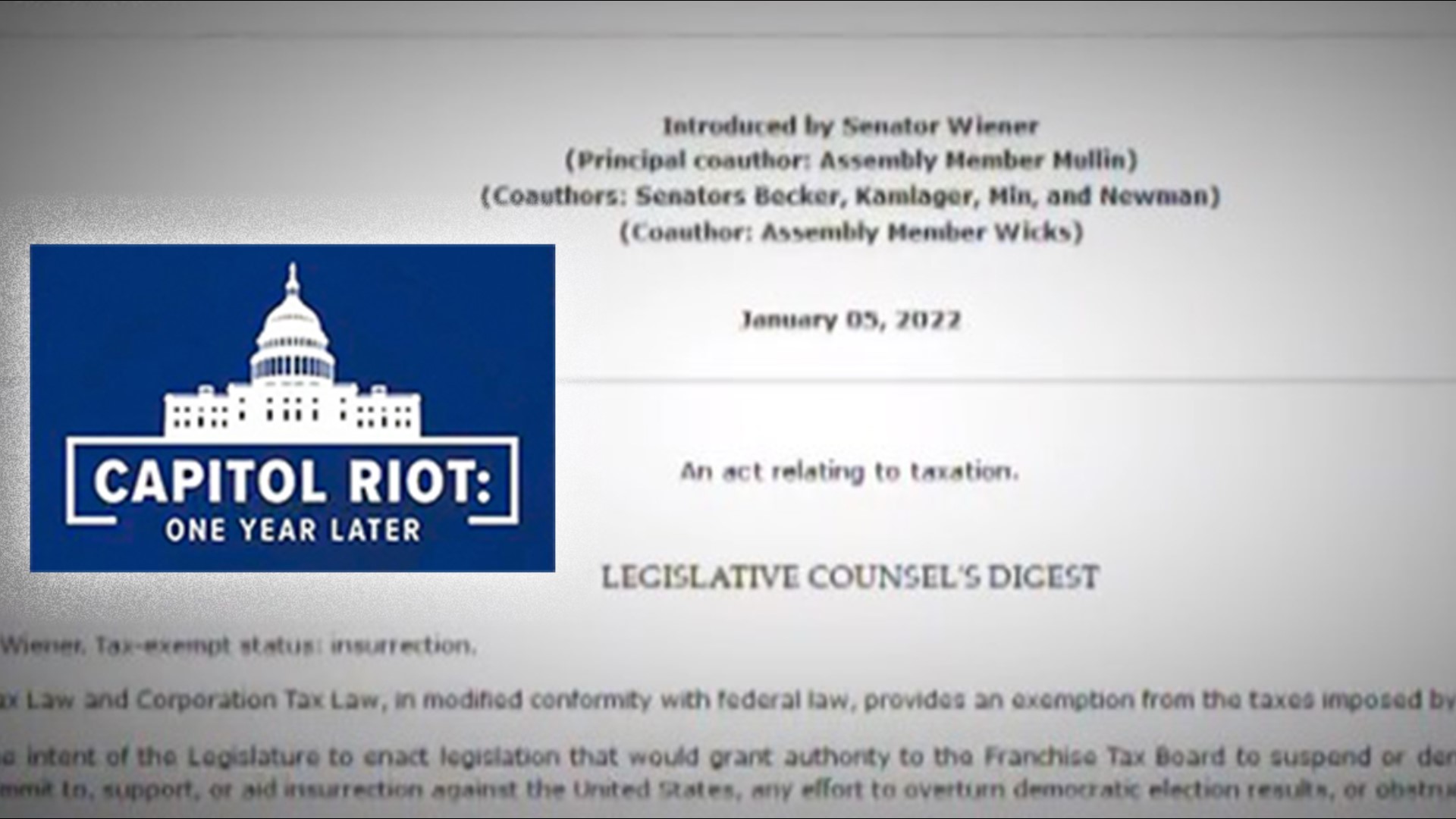

While there is no general sales tax exclusion for nonprofit organizations certain types of organizations are eligible for specific tax exemptions and exclusions. Late last week a new bill that would eliminate California Franchise Tax Board FTB filing fees for non-profit organizations was introduced to the Senate. Find out if your account with us is active or suspended.

For nonprofits especially there are specific criteria and nonprofit tax filing standards that must be observed to maintain your 501c3 designation. Non-Profit Tax Filing in California. The Welfare Exemption.

Generally a nonprofits sales and purchases are taxable. A nonprofit entity can either. Although sales tax can be passed on to customers who buy goods an organization is responsible for paying it unless it fits within one of the states specific exceptions.

Our firm has experience with all types of business entities and nonprofit organizations. Generally a nonprofits sales and purchases are taxable. Most Property Is Subject to the Property Tax.

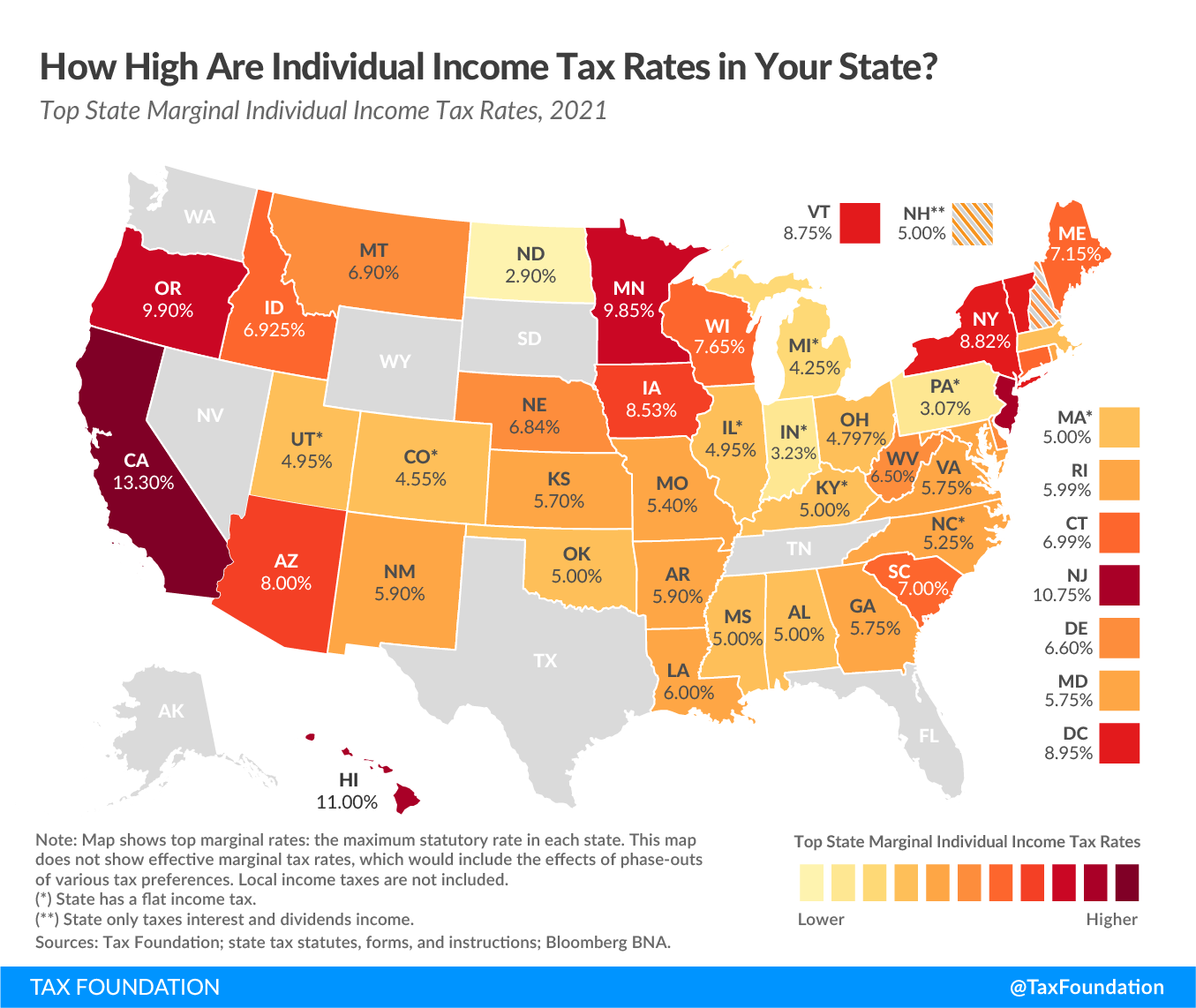

Also do not file an amended return if you forgot to attach tax forms such as a Form W-2 or a schedule. If your nonprofit spends lets say 20000 per year in such employee benefits then you must report 20000 as unrelated business income and pay 21 taxes on it UBIT Unrelated Business Income Tax. Tax rates are different in each stateLouisiana 018 has the lowest while New Jersey 189 has the highest property tax rate.

Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. N umerous nonprofit devout organizations are excluded from government and state wage assess. Many nonprofit and religious organizations are exempt from federal and state income tax.

Check your account status. These taxpayers will no longer receive a rebate in the form of a tax deduction when they make charitable donations. The California Legislature has the authority to exempt property 1 used exclusively for religious hospital or charitable purposes and 2 owned or held in trust by nonprofit organizations operating for those purposes.

24 Feb 2020 141 pm. Pay the same UI taxes as those paid by commercial employers experience rating method. Refer to the Information Sheet.

Tax-exempt status means your organization will not pay tax on certain nonprofit income. As a result the true cost of. Your organization must apply to get tax-exempt status from us.

You will have to file Form 990T and pay 4200 21 in taxes as calculated on the 990T. With this extra 21 tax your cost of providing these benefits rises to 24200. By and large a.

The nations average rate is 107 which is pricey compared to Europe and the rest of the world. Filing annual taxes is a complicated endeavor for anyone. The State Constitution authorizes the Legislature to exempt certain property including property owned by charitable nonprofits.

If your nonprofit spends lets say 20000 per year in such employee benefits then you must report 20000 as unrelated business income and pay 21 taxes on it UBIT Unrelated Business Income Tax. To keep your tax-exempt status you must. In the State of California this exemption is known as the Welfare Exemption.

Senate Bill 934 introduced by Senator Patricia Bates R-Laguna Niguel would get rid of the current 25 filing fee for non-profit organizations looking for a tax exemption starting in 2021. Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax. But theres no comparable wide exclusion from deals and utilize charge in places like California.

It is common knowledge that nonprofit organizations generally do not pay income tax. If your nonprofit organization owns or leases property this presentation will be beneficial to you. But did you know that nonprofit organizations that qualify for federal tax-exempt status are by law also exempt from paying property taxes.

2021 the internet website of the California State Board of Equalization is designed developed and maintained to be in compliance with California Government Code Sections 7405. Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax. This exemption is known as the Welfare Exemption and was first adopted by voters as a constitutional.

Non-Profit-World will help ensure your organization meets them regardless of what state you operate in or the size of your organization. California Seals California Tehama County California Tattoo Other Nonprofits Organizations meeting specified requirements may qualify for exemption under subsections other than Section 501c3. California System of Experience Rating DE 231Z PDF for more information on the experience rating method.

This exemption known as the Welfare Exemption is available to qualifying organizations that have income-tax-exempt status under. So they will take the fixed standard deduction instead. Real and personal property owned and operated by certain nonprofit organizations can be exempted from local property taxation through a program administered by the Board of Equalization and county assessors offices in California.

Property Tax Rates Explained. Nonprofit pay sales tax in California. Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax.

Maintain your records with. Be formed and operating as a charity or nonprofit. All California property is subject to the property tax unless exempted.

Property Tax Exemption Information for Nonprofit Organizations. Check your nonprofit filing requirements. Your annual tax bill is calculated by multiplying the assessed value of the.

990n Form Irs Tax Exempt Nonprofits Tax Information For Filing Must Set Up Initial Profile Once Irs Taxes Non Profit Internal Revenue Service

A Complete Guide To California Payroll Taxes Rjs Law

California Property Tax Exemptions For Nonprofits Annual Filings Due Feb 15 2022 Legacy Advisors

Church Law Center What Tax Exempt Means For California Nonprofits Church Law Center

Understanding Where California S Marijuana Tax Money Goes

Ca Sales And Use Tax Guidance For Not For Profits

Applying For The California Property Tax Welfare Exemption An Overview Nonprofit Law Blog

Unaffordable California It Doesn T Have To Be This Way

M M Financial Blog We Solve Tax Problems Debt Relief Programs Tax Debt Relief Irs Taxes

California Seals California Tehama County California Tattoo

Irs Tax Problems Top 3 Reasons Use An Irs Tax Attorney 619 639 3336 Tax Attorney Irs Taxes Tax Lawyer

Ca Sales And Use Tax Guidance For Not For Profits

Church Law Center What Tax Exempt Means For California Nonprofits Church Law Center

Bill Would Strip Tax Exempt Status For Engaging In Insurrection Abc10 Com

You May Not Want To Hear How Much Money You Have To Make To Live In Colorado Map 30 Year Mortgage Usa Map